Have you heard about DUNS number? If not, now it is time to get one for your small business.

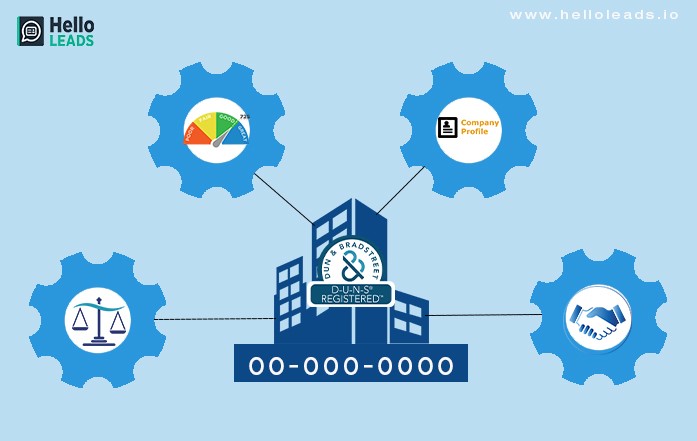

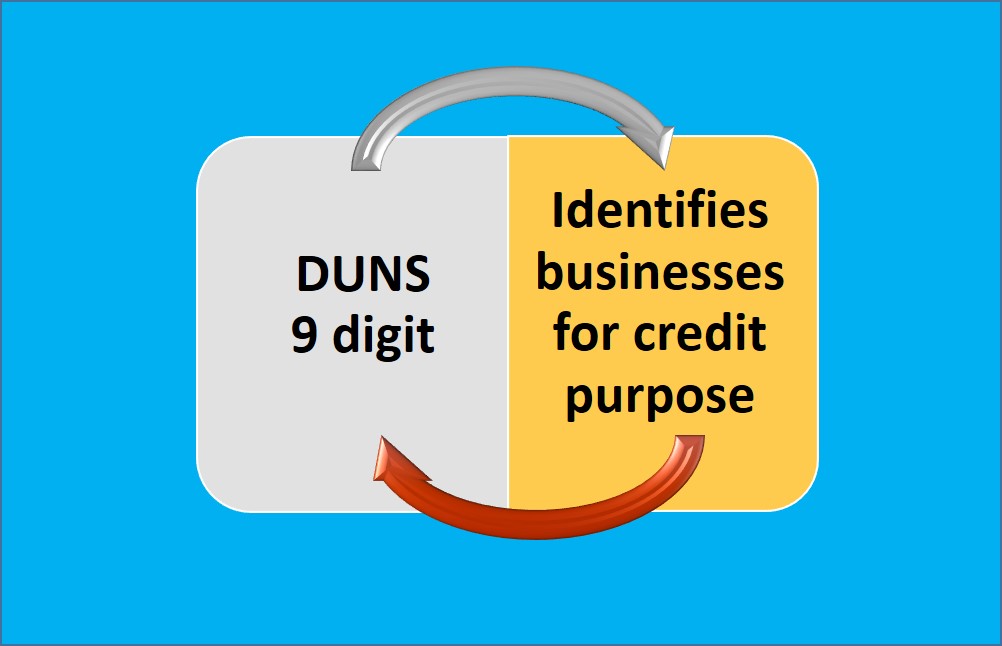

A D-U-N-S or Data Universal Numbering System is a unique nine-digit number issued by the data and analytics services provider Dun & Bradstreet to a business entity. This number was introduced in 1963, which helps to predict a company’s business credit file and helps lenders and business partners to get an idea of a company’s reliability and financial stability.

Why do you need a DUNS number?

Getting a DUNS number has the following merits:

- Helps to track your business’s credit

- Manage risk and reduce cost

- Keeps your personal and business credit separate

- Establish creditability with lenders for loans & contracts

- Allows you to do business with government & companies outside the U.S.

- Allows you to learn more about a business that you want to work with

Applying for a DUNS Number is relatively easy and can be done using the D&B website. The DUNS application should take you between five to 10 minutes. Getting DUNS is free for up to 30 days unless you expedite it to get it in 5 days or sooner.

Before applying for a DUNS number, you have to provide the following:

- Name of your organization

- Business address

- Mailing address

- Owner’s name

- Nature of the business

- Number of employees

- Contact number

- Contact name

- Whether you are a home-based business

Here you go with 5 easy steps to get your DUNS number,

Step1 : Enter into the D&B website :

First, visit the D&B website. Once you visit the D&B website, on the DUNS Number request page, it shows you to get started.

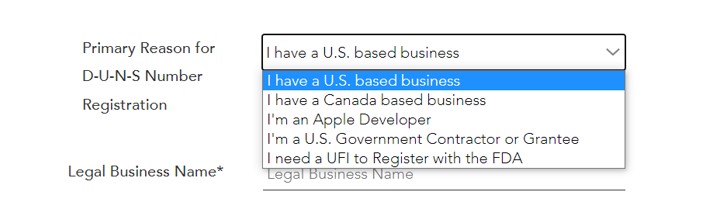

Step 2 : Select the primary reason :

After getting started, it will ask you for the primary reason for registering a D-U-N-S number. You can select any one option from the given list. For example, if you’re doing a United States-based business without depending on the federal government, then select “I have a U.S. based business”.

If you are doing as a contractor/grantee for the US government, you can visit the D&B D-U-N-S request service for US Federal Government Contractors and Assistance site and request your DUNS Number there.

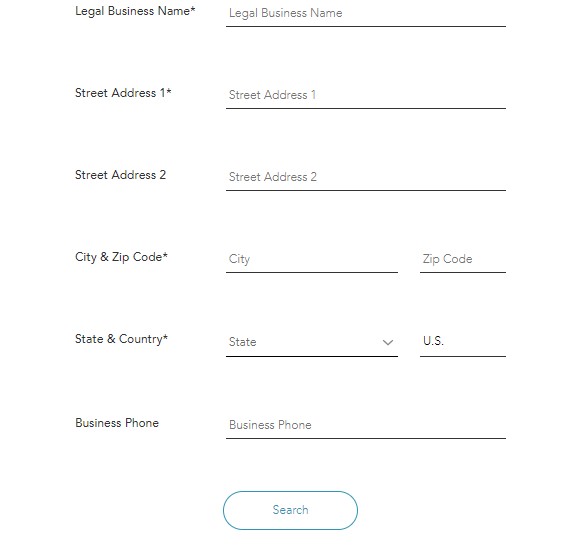

Step 3 : Search your business :

Next fill in the necessary business details such as legal business name, mailing address, etc. Then, click search to check whether D&B has already created a DUNS number for your business or not.

Step 4 : Request a new DUNS number :

You will get the line “Get a New D-U-N-S Number” at the bottom of the page if your entered business information is correct and verified for moving to the next step. This means that the D&B file does not have your business on it already. By clicking this, you can get a new DUNS number.

Step 5 : Choose your delivery package options :

Once you have finished the company search, you will enter into the D&B credit file package options. There are multiple package options to select and request your DUNS number. The options are free of cost for 30-day delivery or expedited 5 days delivery with a cost of around $229.

Other information also you should know :

- You have an option to monitor your business credit file. Once you have your D‑U‑N‑S Number, you can monitor your business credit file. D&B CreditSignal® is a free, alerts-based business credit monitoring product that uses indicators to show changes to the scores and ratings in your business credit file at all times

- You can look up your partner’s business or find your business D-U-N-S Number

- You can review and update your company’s D&B business information for free. Any updates for a business name, business address, contact numbers, annual sales & number of employees, etc. to an existing D-U-N-S Number. This will take up to 7 business days.

- If you received the message, “Your organization is not listed as a legal entity” during enrolment means, your business is listed as a legal entity. If you believe your business should be listed as a legal entity and have business registration documents already, then email to D&B.

- You can get a variety of scores & ratings from D&B once your DUNS number is established. This scores & ratings act as a signal to lenders and businesses if your company has a reliable payment history.

Bottom Line :

DUNS number can help your partners to see financial health indicators of your business, such as your D&B business credit score and ratings, information on suits, liens, judgments, and other types of activity. This will help them to decide whether to work with your business.

DUNS is a type of tool to set your business towards success, especially when you want to grow in the future.

Share this blog :